Call 503.474.6814 - Email us

Business Incentives

McMinnville has programs and organizations that can help businesses locate or expand in our region. The State of Oregon also offers incentives for business grants, tax incentives, expansion programs, and more. Learn what incentives are available and how to qualify.

McMinnville Industrial Promotions discuss land options for a shovel-ready site in McMinnville

McMinnville Industrial Promotions discuss land options for a shovel-ready site in McMinnville

Programs in McMinnville

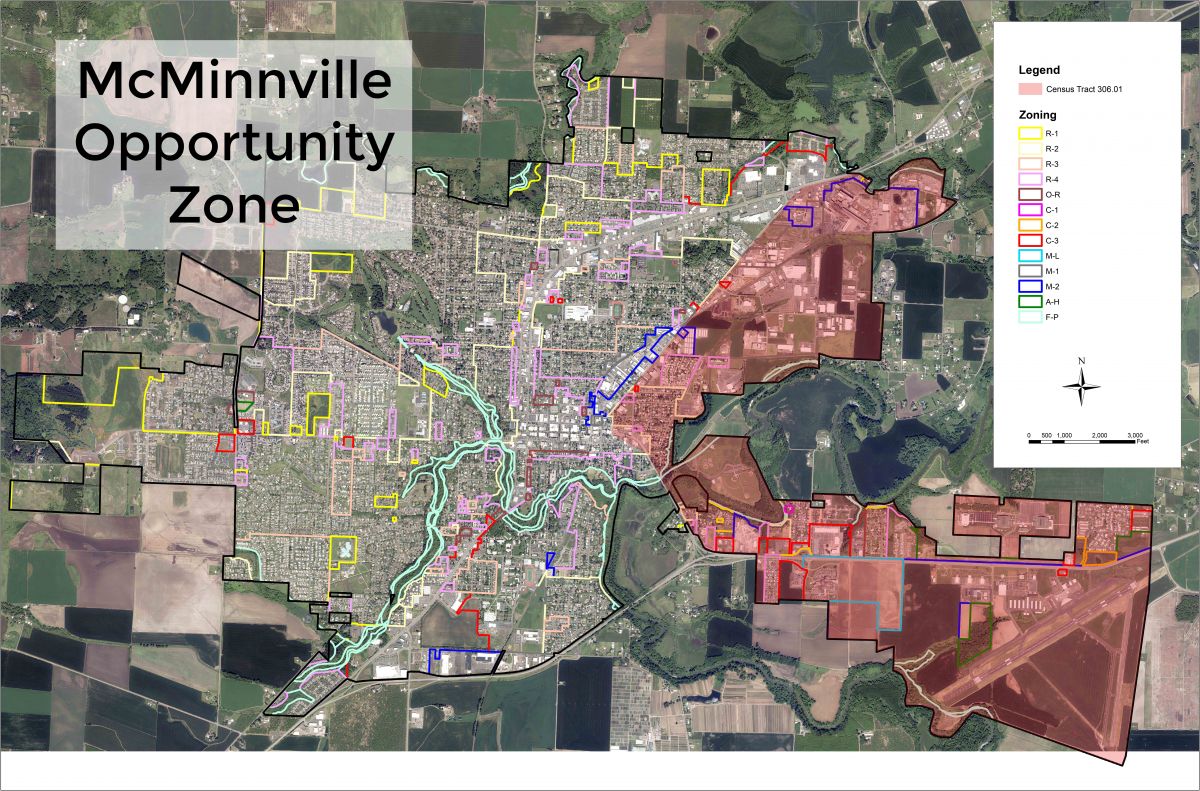

McMinnville Opportunity Zone

In 2018, the US Treasury made opportunity zone designations across the country to encourage long-term investments through a federal tax incentive. McMinnville has a designated zone through census tract #306.01.

Learn more about Opportunity Zones.

Call us at 503-474-6814 to learn more about McMinnville's Opportunity Zone

McMinnville Industrial Promotions

McMinnville Industrial Promotions (MIP) is a group of long-time community members and business leaders who help newcomers and existing businesses access facilities, permits, and professional services. MIP currently owns a number of buildings and properties within the McMinnville city limits that are ready to lease, purchase, or build-to-suit. The MIP Board of Directors services are free of charge. MIP works with manufacturing businesses to get the groundwork done. They help make sites shovel ready, conduct environmental studies, arrange for utility hook-up, and more.

To learn more or to connect with MIP, please email info@mcminnvillebusiness.com

On-the-Job Training

On-the-Job Training Program helps companies and organizations hire and train new and current employees. The program reimburses companies for the hours committed to training employees while on-the-job. The program is open to private businesses and nonprofit entities.

To see if your business qualifies for the On-the-Job Training Program, contact:

WorkSource Oregon

(503) 472-5118

The On-the-Job Training program is funded by Incite, Inc.; our regional workforce board, and is run by WorkSource Oregon.

Urban Renewal Area

McMinnville's Urban Renewal area is part of a statewide program in which a concentrated use of tax revenues can be used to enhance an area of a city. This includes property renovations, street improvements, developing utilities, and more. See properties within McMinnville's Urban Renewal Zone. There are three Urban Renewal Programs in place:

- Facade Improvement Grant Application - A matching grant program used to improve the aesthetic appearance of the exterior facades of existing buildings/businesses, to restore the unique historic character of building, and to encourage private investment in District properties and businesses. Maximum individual grant is limited to $2,500.

- Free Design Assistance Application - "Up to 10 hours or $1,000 of free design assistance from a pre-qualified list of vendors to help with development and redevelopment projects."

- Property Assistance Loan Application - "Provide an ongoing source of gap financing for new construction or substantial rehabilitation projects that provide an immediate increase in assessed value and support additional goals" (loans are currently capped at 20% of construction costs, cannot exceed $100,000 and are dependent upon available funding).

Yamhill County Economic Development Grants

Start Ups, Strategic Investment Funds and Small Grant opportunities. The Economic Development Grants Program seeks to support innovation and sustainable growth through strategic investments of development initiatives that create or retain jobs, generate increased economic activity, and improve the economic and social livability and vitality of local communities. Visit for more information: Yamhill County Economic Development Grants

Oregon State Incentives

Oregon's tax structure ranks 11th in the U.S. for business friendliness. Oregon also offers globally competitive incentives to help businesses expand, locate, and start.

Tax Expenses Business Do Not Pay in Oregon

- General sales tax

- Use tax on equipment or any other purchase

- Inventory tax

- Worldwide unitary tax

- Motor vehicle excise tax

- Levies on capital asset tax or intangible properties

Property Tax Abatement

- Construction-in-Process - Facilities which have unfinished improvements may be exempt from property taxes for up to two years.

- Food Processing Machinery and Equipment - Allows food processors to request a tax exemption on qualified machinery, equipment, and personal property.

State Income Tax Credit

- Qualified Research Activities Credit - A corporate credit given for increases in qualified research expenses. The research must be conducted in Oregon and be in the fields of advanced computing, advanced materials, biotechnology, electronic device technology, environmental technology, or straw utilization.

- More tax credits and information can be found at Oregon Department of Revenue

Other

- Oregon Business Expansion Program - A cash-based incentive (forgivable loan) for companies who already have 150+ employees and who plan to hire 50 or more full-time employees in Oregon. The incentive is equivalent to the estimated increase in income tax revenue from new hiring.

- Small Manufacturing Business Expansion Program - A cash-based forgivable loan for small manufacturers based in Oregon who are completing expansion projects.

- Work Opportunity Tax Credit - A Federal tax credit given to private-sector businesses who hire individuals who face significant barriers to employment.

- Film and Video Incentives - Programs to urge the production of video and film in Oregon.

- Oregon Production Investment Fund (OPIF) - rebates 20% of goods/services and 10% of Oregon-based payroll on projects who spend a minimum of $1M.

- Greenlight Oregon Labor Rebate - rebates 6.2% of payroll for which Oregon withholding applies on video or film projects who spend a minimum of $1M in Oregon.

Renewable Energy Incentives

- Solar Development Incentive Program - A cash incentive per kilowatt-hour of electricity generated to owners of photovoltaic energy systems with a nameplate capacity of 2 to10 megawatts.

- Fee in Lieu of Property Taxes - After forming an agreement with a county (and city), any solar project can choose to pay a fee rather than property taxes for up to 20 years. The fee will equal $7,000 per megawatt of the project's nameplate capacity.

- Alternative Energy Systems (ORS 307.175) - A tax abatement which exempts property equipped with alternative energy systems from ad valorem property taxation.

“We have about 15 different sites in a number of other states, and McMinnville has immediately felt like home. Everyone has made us feel welcomed from the beginning.”

– Sam Ramierz, Former Chief Operating Officer, Wings & Waves Waterpark

Looking for more information? Give us a call at 503.474.6814

Business

- Resources

- Properties

- Workforce

- Data & Costs

- Industries

- Incentives

- FAQs

- Tech Terroir

- MEDP Workforce Programs